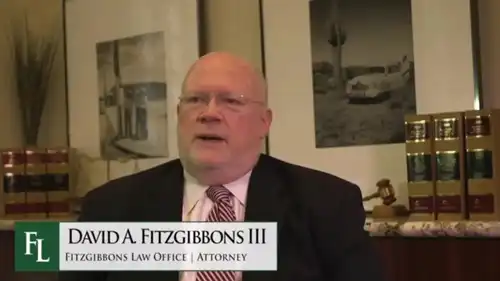

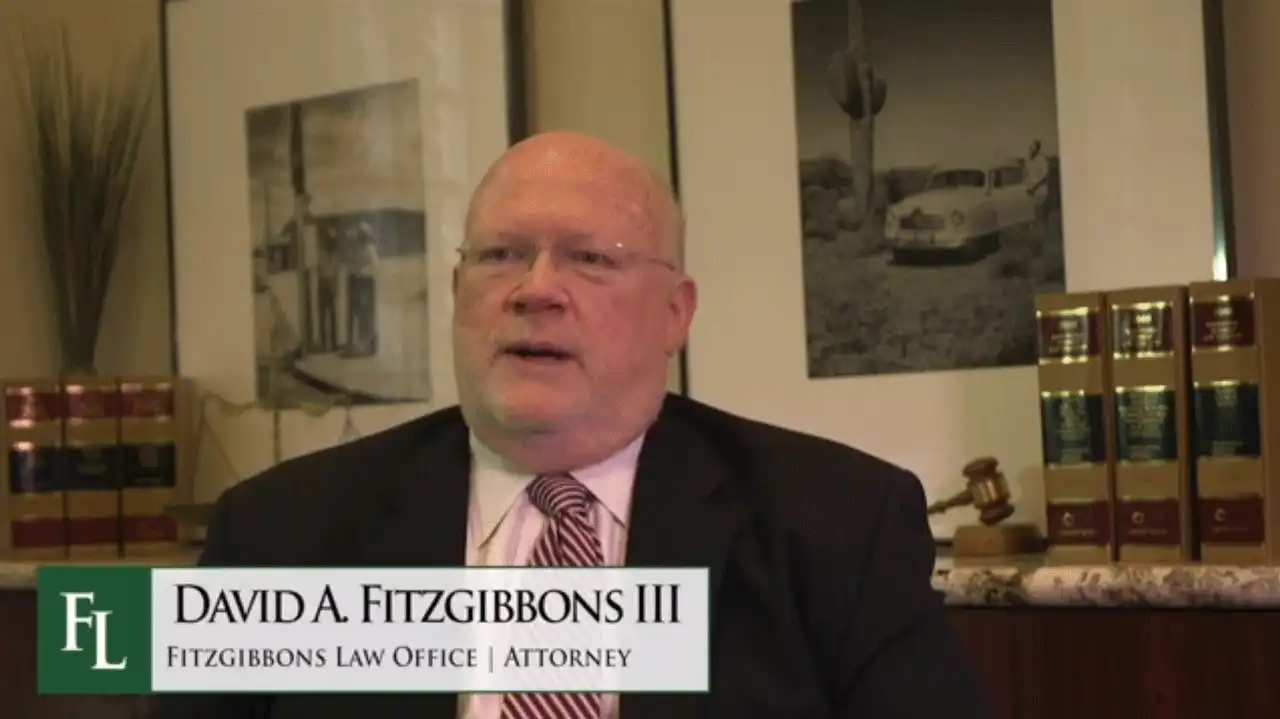

Casa Grande Business Attorneys

Casa Grande Business Attorneys

Business and Corporate Attorneys for Growing Arizona Companies

Our business attorneys assist and counsel business owners throughout Pinal County — and out-of-state companies seeking to join the central Arizona business community — in entity formation and in negotiating and documenting business transactions.

Entity Formation

Choosing which type of entity to form is one of the most important decisions to make when starting a business. Arizona law provides for a variety of business entity options, and each entity works differently to protect certain assets and determine tax, debt, and legal liability.

Our business attorneys are knowledgeable about the benefits and disadvantages of each type of entity, and can advise you on which would be most appropriate for your business venture. We assist clients in forming:

- Corporations

- Non-profit corporations (NPOs)

- Limited liability companies (LLCs)

- Limited liability partnerships (LLPs)

- Professional limited liability companies (PLLCs)

- Professional limited companies (PLCs)

- Joint ventures

- Sole proprietorships

- Employee stock ownership plans (ESOPs)

Fitzgibbons business attorneys also offer strategic and operational guidance that help ensure that the type of entity selected will deliver the tax, liability protection, and other advantages that will serve the owners' interests:

- Governance issues

- Buy-sell agreements

- LLC operating agreements

- Corporate bylaws

- Other shareholder/member/partner agreements

Business and Real Estate Transactions

Our attorneys negotiate, review and draft contracts to protect our clients' interests and ensure there are no ambiguities that may lead to costly misunderstandings or disputes later on. Our services include handling all aspects of:

- Mergers and acquisitions

- Business contracts

- Stock purchase agreements

- Franchising agreements

- Real estate sale and lease agreements

We also facilitate business transactions under the Uniform Commercial Code (UCC), which governs the purchase and sale of goods; leases; and negotiable instruments such as banknotes, bank deposits, funds transfers, and letters of credit. We assist vendors and buyers in preemptive planning, including negotiating deals and contracts, and helping to ensure that injured parties are placed in as good a position as if the other party had fully lived up to their obligations.:

Business Articles

| Fitzgibbons Law Offices, P.L.C.

New ParagraphAttorneys providing legal services in personal injury, wrongful death, bankruptcy, employment law, estate planning, probate, civil litigation, real estate law, business law, and entity formation in the Pinal County communities of Casa Grande, San Tan Valley, Coolidge, Apache Junction, Eloy, Maricopa, Florenc e, Kearny, Queen Creek, Superior, Winkelman, San Manuel, Sacaton, Marana, Arizona City, Gold Canyon, Red Rock, Oracle, Casa Blanca, Dudleyville.

The act of visiting or communicating with Fitzgibbons Law Offices P.L.C. via this website or by email does not constitute an attorney-client relationship. Communications from non-clients via this website are not subject to client confidentiality or attorney-client privilege. Further, any articles, discussion, commentary, forms and sample documentation contained in this website are offered as general guidance only and are not to be relied upon as specific legal advice. For legal advice on a specific matter, please consult with an attorney who is knowledgeable and experienced in that area. Attorneys listed in this website practice only in the jurisdictions in which they are admitted. This website is governed by the Arizona Rules of Professional Conduct.